An Atlanta Civic Circle investigation in May found that the city of Atlanta was using most of its special housing trust fund to pay down housing-related bond debt and employee salaries, instead of creating new housing.

That contradicted the intent of the 2021 enabling legislation for the Atlanta Housing Trust Fund, alarming housing advocates and city officials alike. Some critics went so far as to label the trust a “slush fund.”

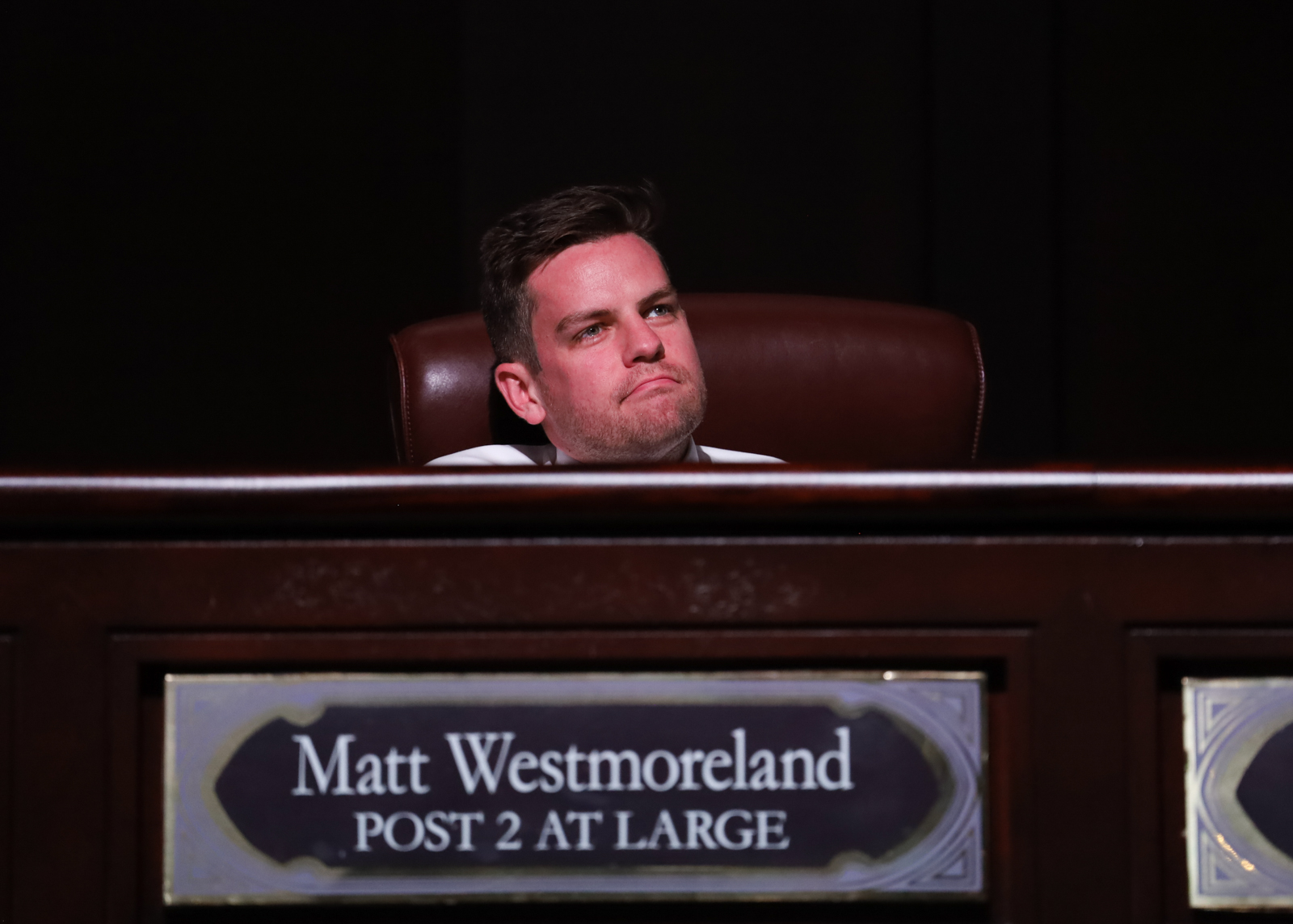

But Atlanta City Councilmember Matt Westmoreland has offered a fix: update the city’s charter, where the trust is codified, to ensure the fund spends more on creating housing for poor people than it does on debt service and payroll.

In fiscal year 2025, Mayor Andre Dickens’ administration allocated almost $13 million — over 75% of the $17 million disbursed to the housing trust — to pay $8.8 million toward housing-related bond debt and at least $4 million for city staff salaries.

Westmoreland on Monday proposed amending the city’s charter to require that at least half of the trust fund gets spent on affordable housing construction, with another 30% going to nonprofits’ housing programs. If the city council approves the measure as written, only 15% of the trust’s annual funding could be used to service housing bonds and just 5% could pay administrative costs and staff salaries.

All those guardrails revolve around one overarching goal: commit at least half of the trust fund money to provide housing for families who earn no more than 50% of the area median income (AMI), or about $57,000 a year for a four-person household. That’s a demographic that experts say is in dire need of “deeply affordable housing.”

“My North Star is the construction of housing, especially at 50% of the AMI and below,” Westmoreland said in an interview. “The general fund is an appropriate place to fund the salaries of people who are focused on this work.”

The housing trust fund receives 2% of the city’s general fund each year, which amounted to $19.5 million in FY26. The trust also receives in-lieu fees from developers that opt not to include affordable housing in multifamily projects in the Beltline and Westside inclusionary zones.

Andy Schneggenburger, who chairs the Atlanta Housing Commission, an independent advisory body to the city council, called Westmoreland’s proposal “a step in the right direction.” It remedies an oversight that allowed the city to tap the trust fund for any purposes it deemed housing-related, he said.

Schneggenburger suggested the city council take that a step further and require that 75% of the trust’s annual income get spent directly on housing for people making below 50% AMI.

Atlanta CFO raises objections

Atlanta’s chief financial officer, Mohamed Balla, said restricting the trust’s expenditures mostly to housing construction would place too great a strain on the city’s general fund, because it would have to pick up additional housing-related expenses, like staffing.

The city has hired about 40 people to handle housing issues since the trust fund was created, Balla said. “Shifting that burden over to the general fund essentially shifts that burden over to taxpayers,” he said, meaning the city would either have to raise taxes or divert funding from other departments.

The approximately $4 million drawn from the trust to pay city salaries last fiscal year would amount to 0.4% of the city’s current $975 million general fund. For context, Atlanta’s biggest FY26 budget expense is for police at 30.2%, followed by nondepartmental expenses (insurance, debt service, workers’ compensation) at 14.4%, and fire at 13.9%.

Balla added that there’s precedent for paying employees handling housing matters out of the housing trust. “The arborists are paid out of the Tree Trust Fund. The people who work in park improvement are paid out of the Parks Improvement Fund,” he pointed out.

Westmoreland countered that the city is also reconsidering how it funds parks department salaries. What’s more, he added, the city used the general fund to pay down housing bonds before the trust’s advent in late 2021.

“We’re trying to supplement, not supplant, what great work we’ve been doing on the housing front,” he emphasized. “The first [Housing Opportunity] bond was issued back in 2017, and we had people on the payroll who were focused exclusively on housing affordability then.”

“I think it is acceptable and appropriate for some percentage of this trust fund to be used to help cover a portion of someone’s salary and to cover bond debt,” Westmoreland continued. “But the whole reason we created it was to support nonprofits and build housing units at the lower AMI levels.”

Balla also expressed concern about Westmoreland’s proposal that the housing trust must spend half its annual income to build or subsidize deeply affordable housing, priced for people making just 50% AMI. That could stifle housing production at higher price points that are still below market, he warned.

“What do I do if there’s significant inflation and every single affordable housing developer in the city can only do 60% AMI or 55% AMI?” Balla asked. Construction costs are already rising for housing developers, as the Trump administration deports undocumented construction workers and its tariffs drive up building material costs, Balla pointed out — and developers will bear even more of those costs if federal housing subsidies dry up.

That’s all the more reason to enact the measure, Westmoreland said. “He’s making my point. It’s getting harder to finance the construction of housing at 50% AMI,” the council member concurred — and so increased funding from the housing trust can help private developers do that. “We need to be spending as much of this trust as possible on units at 50% AMI and below,” he said.

Schneggenburger added: “The city has full control over how they fund their overhead. They have chosen to rely on the housing trust fund for some salaries because it’s free money that’s already set aside — but it all comes from the general fund, doesn’t it?”

This is a great step. Hope he can get the 8 votes.

I also see this as him trying to outflank CM Dozier in the race for mayor 4 years from now. Yes, I’m a political cynic