Investigative reporting and community storytelling about the cost of living in Atlanta

In partnership with

The Cost of Living Project is an innovative look at the price we pay to live in metro Atlanta.

This conversation is about more than escalating home and rental costs; over the course of this project, we’ll explore the cost of living through food, wages, transportation, childcare, education, and healthcare—in addition to housing.

Articles & Stories

The Melody transforms shipping containers into housing for some of Atlanta’s unhoused community membersA resident enters the MelodyCost of Living Fellow Iris BrooksThis story is part of a series called “Rethinking the American Dream.” Through these vignettes, Cost of Living Fellow Iris Brooks is exploring how innovative housing solutions—like land trusts—can address Atlanta’s affordability crisis. Brooks lives in a multigenerational home, sharing space with several family members, a living arrangement that has become increasingly common as housing costs rise. She has lived in Decatur for 13 years.In a city grappling with homelessness and affordable housing shortages, the Melody is an experiment in rapid housing solutions. By converting shipping containers into micro-apartments, this facility addresses the immediate need for housing while providing wraparound services designed to help residents rebuild their lives. Named after a woman who died while experiencing homelessness, the Melody serves as a shelter and a stepping stone.A common space features lawn chairs and potted plantsThe Melody on Forsyth Street represents an innovative approach to addressing homelessness in Atlanta. Opening last year, this project transformed 20 shipping containers into 40 studio apartments, each measuring 160 square feet. Named in honor of Melody Bloodworth, an Atlanta resident who died while unhoused in 2022, the facility focuses on preparing residents for independent living.George Jack Suddeth sits in an open courtyardThe Melody operates under the principle that some residents may make it their permanent home through cost-sharing arrangements, while others work toward independent housing. Staff emphasize budgeting skills and personal responsibility, helping residents avoid returning to homelessness. Behavioral health clinicians provide on-site support.The program requires residents to maintain budgets and demonstrate accountability for personal expenses. This structured approach aims to break cycles that may have led to homelessness while providing stable housing and support services.George Jack Suddeth sits in the entrance to his Melody homeGeorge Jack Suddeth, a 44-year-old former truck driver and “Grady Baby,” arrived at the Melody after suffering five strokes in two years that significantly impacted his health. The strokes ended his trucking career and dramatically changed his daily capabilities; he said the Melody staff have provided support during this vulnerable time. “They care. They gave me a room and I talk to all of them,” Suddeth said. His mobility is limited. He doesn’t venture out much but can manage trips to the grocery store when necessary. The discovery that he could remain at the Melody permanently provided crucial stability. “I found out a couple of months ago that this wasn’t just a year, that they put me in for permanent housing here, which means that I can stay here,” he said.Suddeth’s immediate goals focus on regaining mobility and relearning to read so he can manage his medication and mail on his own. “I got a dictionary in my room. I keep going over words, and I try to pick out seven words, and I got a week to learn them,” he said.He said he’s grateful for the support while he works toward recovery. “If it wasn’t for Evolution and the Melody, I wouldn’t be where I am now. Because of them, I am learning how to do things that I need to do.”Sherlyn Freeman sits in the Melody’s courtyardSherlyn Freeman, a 54-year-old mother of seven and grandmother of 16, moved into the Melody last year following a mental health crisis that had required emergency intervention and hospitalization. Later, support services helped her access medication and move into the Melody.Freeman’s focus remains on achieving independence. “I’m working towards getting me housing. That’s my goal. I like it here, don’t get me wrong,” she said. “It is amazing, but I want to be on my own and show people that I can.”She’s motivated by her children and grandchildren. “I can make sure my bills paid, make sure everything is right, so I can get the relationships back that I lost,” she said.Her current priority remains self-improvement: “I can only focus on me right now.” •Do you live in a nontraditional housing setup? From shared spaces to ADUs, we want to hear how you make it work. Share your story with us for a chance to be featured in this series exploring how Atlantans are reshaping what home looks like.Read more

Oak Cottage Court offers workforce housing to professionals priced out of Decatur’s marketOak Cottage Court resident Linda Stapleton, standing on her porchCost of Living Fellow Iris BrooksThis story is part of a series called “Rethinking the American Dream.” Through these vignettes, Cost of Living Fellow Iris Brooks is exploring how innovative housing solutions—like land trusts—can address Atlanta’s affordability crisis. Brooks lives in a multigenerational home, sharing space with several family members, a living arrangement that has become increasingly common as housing costs rise. She has lived in Decatur for 13 years.As Decatur’s housing costs have soared, teachers, city employees, and other professionals have found themselves in an impossible position: earning too much to qualify for traditional affordable housing but not enough to afford market-rate homes in the community where they work. Oak Cottage Court represents an innovative solution to this housing gap, using a land trust model that makes homeownership accessible while preserving community character and preventing displacement.A fire pit at Oak Cottage Court, used for community get-togethersThis workforce housing community on Commerce Drive in downtown Decatur offers homes to residents earning between 80 percent and 120 percent of the area median income. The Decatur Land Trust owns the land while residents purchase the structures, making homeownership more accessible to teachers, city employees, and other professionals priced out of the market.The community prioritizes walkability, allowing residents to walk to schools, work, and local amenities. While the application process involves extensive paperwork, homeownership classes, and specific income requirements, successful applicants receive 100-year renewable leases and can pass their homes to descendants. The model addresses concerns about gentrification and prioritizes equity, access, and quality of life, although residents acknowledge that even these “affordable” homes remain out of reach for many potential buyers.Courtney Hartnett, a gifted program specialist at Oakhurst Elementary School, discovered Oak Cottage Court after two decades of hearing teachers discuss how they couldn’t afford to live where they worked. “I’ve worked in the school system for almost 20 years, so they have always had this conversation: Teachers work in the school system, but you can’t afford to live here,” she said.“I’ve worked in the school system for almost 20 years, so they have always had this conversation: Teachers work in the school system, but you can’t afford to live here.” Courtney Hartnett, gifted program specialist at Oakhurst Elementary SchoolThe application process was thorough. “I walked through all the steps. At first, there was a webinar, just to make sure you understand what owning a home on a land trust would entail with Decatur Land Trust and Atlanta Neighborhood Development Partnership,” Hartnett said. One of the residences at Oak Cottage CourtEventually, she sold her home in White Oak Hills and used the profits to purchase in Oak Cottage Court. The move transformed her family’s daily life. Her children can now walk to school with friends. Hartnett appreciates being close to “things that are important to us, like going to school, friends’ houses.”For Hartnett, the land trust model represents more than affordable housing. “I appreciate Decatur’s emphasis on things like equity, access, diversity, and quality of life—like even just walkability. It increases everybody’s quality of life but also builds strong communities. I think affordable housing has to be a part of that conversation.”“I appreciate Decatur’s emphasis on things like equity, access, diversity, and quality of life—like even just walkability. It increases everybody’s quality of life but also builds strong communities. I think affordable housing has to be a part of that conversation.” —Courtney Hartnett, Oakhurst Elementary School gifted program specialistLinda Stapleton, a Georgia State University employee, spent years searching for the right home before moving to Oak Cottage Court. “Thankfully, I was in a position where I didn’t have to do anything quickly. I could take my time,” she said.The application process proved challenging. “It was jumping through hoops a lot,” Stapleton described, noting more paperwork than a traditional home purchase due to land trust requirements. Applicants cannot rent out their homes, and there are specific stipulations about selling. Selection operates on a first-come, first-served basis among qualified candidates. “I don’t have debt, but someone who did, they wouldn’t have been able to get the loan,” she said.Linda Stapleton in her home“My car is paid for. I don’t have student loan debt. But a lot of people are in a different stage of life, and they do have those things. What if you have child support, alimony, or something? Even though this is affordable housing, you would not have been able to purchase. That’s something that is really above me, but I know it needs to be addressed,” Stapleton explained.Despite the complexity, Stapleton is happy with her decision. She chose the area because “I have a grandbaby—my one and only grandbaby—and he’s just two miles away.” The location offers walkability to a nearby park and Publix.Having moved from a condo in Sandy Springs, Stapleton embraces smaller spaces. “When you think about what you actually use in your home, you might realize that you have a favorite chair or someplace you like to eat or have a cup of coffee,” she said. “Sometimes you’re paying for something you’re really not using.”Now settled, she’s considering retirement: “I could see myself living here for the rest of my life.” •Do you live in a nontraditional housing setup? From shared spaces to ADUs, we want to hear how you make it work. Share your story with us for a chance to be featured in this series exploring how Atlantans are reshaping what home looks like.Read more

After spending $3,000 to get settled, Logan is learning how quickly costs add upIllustration by Khoa TranLogan moved into his own place for the first time last week. He’s not surprised at how expensive it is. “This is pretty much what I expected because I have friends who live out here,” Logan said. “I already had a realistic expectation [of living near the city].” Still, a lot has changed since moving from Temple to Duluth. To start, Logan—who asked to use a pseudonym so he could speak openly about his finances—took out a $5,000 loan to cover his apartment applications, two months of rent, a security deposit, and fees to set up new utility services. All in all, he’s spent $3,000 just to get settled. He expects to save money on transportation. Before he moved, he spent a lot of money on gas, driving back and forth to Atlanta to hang out. He’s also moved in with his girlfriend, so he’ll no longer have to drive to North Carolina to visit her.Groceries, though? That’s going to cost him. He says food was practically free where he was living before, with a friend’s parents. “Since I lived out in the sticks, we did a whole bunch of organic stuff,” Logan said. They had a mill to grind up grain and baked homemade bread and pancakes. They raised chickens for fresh eggs. “They were trying to stay as natural as they could,” Logan explained.What does he think it’ll be like leaving that lifestyle behind? “Expensive,” he said, and laughed. “We just went to get groceries last night for one week, and it was over $150.”“We just went to get groceries last night for one week, and it was over $150.” —LoganHe says his new apartment has its “quirks,” but he feels like that’s to be expected at his price range. He was looking at a different complex, but they required him to make more than twice what his monthly rent would have been, which wasn’t realistic for him. He said he thinks greed is driving today’s unreasonable housing costs. “They could still make a good profit and help the people,” he said. “But instead, they’re worried about being too greedy and just getting everything they can; basically saying, excuse my French, ‘f-ck the people.’”Ground penetrating radar technicianNeighborhoodLives withGirlfriendAnnual gross incomeRent payment$1,666 (includes wifi and cable)Health insurance cost per month + cost of any prescriptionsPhone plan and monthly subscriptions (Netflix, Spotify, food delivery services, apps, etc.)Utilities per month$89 a month for gas. “TBD on the cost for electricity since I just moved in, but it was a $30 connection fee and $200 deposit just to get it set up,” he said. (Editor’s note: Logan later reached out to let us know his first electricity bill was $350.)Transportation (car payment, car insurance, gas, public transportation, Uber)$150 weeklyRestaurants, fast food, drinks at bars, coffeesLess than $500$1,000 a yearFun (concerts, books, movies, recreational drugs, etc.)$400 a monthClothes/beauty (new shoes, laundromat services, makeup)$100 a monthHow much money would you need to live comfortably in Atlanta? What hourly rate or annual salary would you be happy with?“I make $27 an hour, and that’s the bare minimum I need to support myself in Atlanta,” he said.What’s a nonessential item that you treat yourself to?Concerts, events, etc.What would you like to have (that you don’t)?“My own home and a new vehicle,” he said.What can be done to improve the cost of living in Atlanta?“Gas is ludicrously expensive,” Logan said. “Not to mention having to pay for parking every single place you go.”What do you love most about Atlanta?“I love the opportunities that are present within the city,” Logan said. •Read more

After an unexpected job loss, this computer scientist is taking a big risk to pursue his dream

Jake lost his job in January after his Fortune 500 employer sold his company amid broader cuts in a shaky economy.

Now, he’s taking the opportunity to pursue what he’s always wanted to do—and what drew him to his career in computer science and programming in the first place: video game development. Jake, who asked to use a pseudonym, learned in school that the industry is particularly brutal, but he thinks creating a game on his own might allow him more creative freedom and a bit less pressure. Now, he finally has the chance.

Working from home in Knoxville, Tennessee, Jake had started to feel isolated. So, last year, he sold his house and moved to Atlanta to be closer to friends. He even moved in with some of them while shopping around for a new place. “I wanted to be in an area close enough to the city perimeter; I didn’t want to be all the way up in, like, Cumming,” Jake said. He wasn’t able to find anything he loved in his price range and was still looking when he lost his job. Now, he considers that futile search a good thing.

“Not buying a house immediately and having job savings lets me take some time and invest in what I want—with some sort of safety net,” Jake said. Between what he got from selling his home in Tennessee, the money he’s stashed away over time, and his severance pay, he has about $300,000 saved.

He said he feels comfortable drawing from those savings until next July, as long as he doesn’t have to dip into what he’s set aside as a potential down payment on a home. At that point, he said, he’ll have to “make some sort of decision on, like, doing something part-time to at least offset that cost, or evaluate how well the game stuff is going.”

He said living off his savings is vastly different from receiving a paycheck every two weeks, and he’s afraid that if this doesn’t work out, it may not be easy to jump back into the workforce. But he’s still happy with the choice he’s made, and if there was ever a time for him to take a risk, he says, it’s now.

Even when he was employed, though, he noticed how much the cost of living was rising. Between housing, utilities, and groceries, he said, “things [reached] a crazy fever pitch.”

“If I wasn’t making the money that I was, I don’t know how I would save or how I would have the quality of life that I did,” he said.

He has friends who say their one-bedroom apartment costs $2,500 a month, which would have been about half a paycheck before he lost his job. “For people who [made] less than me, that’s an entire paycheck, or an entire paycheck plus some,” he said. “I don’t know how people not making the money I did—and I still felt like I couldn’t afford a house—can even live on their own and not be in a roommate or live-with-your-family situation, where you can all share the burden.”

Unemployed

Neighborhood

Lives with

Annual gross income

$0 ($144,000 before losing his job)

Rent payment

$850 a month

Student loans and credit card debt

Health insurance cost per month + cost of any prescriptions

$124 a month

Phone plan and monthly subscriptions (Netflix, Spotify, food delivery services, apps, etc.)

$80 a month for phone service, Crunchyroll, and Spotify

Utilities per month

Transportation (car payment, car insurance, gas, public transportation, Uber)

Restaurants, fast food, drinks at bars, coffees

Fun (concerts, books, movies, recreational drugs, etc.)

How much money would you need to live comfortably in Atlanta? What hourly rate or annual salary would you be happy with?

What’s a nonessential item that you treat yourself to?

Coffee and alcohol

What would you like to have (that you don’t)?

Eating out more

What can be done to improve the cost of living in Atlanta?

Improved transportation would be great

What’s the most challenging thing about living in Atlanta?

Everything is so far apart

What do you love most about Atlanta?

The variety of things to do here •Read more

To get an emergency bed in Atlanta, people must cross the city, wait in lines, and meet varying rules. Even then, they may not find help.Read more

Sam hoped to become a tattoo artist, but Atlanta’s rising costs have pushed them out of their apartment—and their passion

Sam went to school to become a registered behavior technician. Still—because of high housing costs and despite their degree and current work in a skilled labor field—they’re moving back in with family. They hope to save money for a while and “hopefully afford rent again in the future.”

“Rent in Atlanta is insane and, with inflation, it keeps going up; it’s like there’s nowhere you can go where it’s actually affordable here,” Sam said.

On top of that, their student loan payments start in August: $500 a month until the full $75,000 is paid off.

Sam loves getting tattoos. In fact, they want to become a tattoo artist themselves. But they feel like following their passion isn’t an option, financially. “Apprenticeships for tattooing aren’t paid,” they explained. “So you’re pouring all of your time into that during the week, but you’re not getting paid for it. But, like, how are you going to pay your bills?”

They know others who are giving up their dreams because of the cost of living, too. “My two best friends—they’ve been married for a couple years—they really want to have a kid, but they literally can’t afford to,” Sam said. “They’re not able to achieve their dream of having a family because of rent, bills, and everything else.”

Registered behavior technician

Neighborhood

Alpharetta

Lives with

Roommate and pets

Annual gross income

$800 a month

Student loans

$500 a month

Health insurance cost per month + cost of any prescriptions

Phone plan and monthly subscriptions (Netflix, Spotify, food delivery services, apps, etc.)

Utilities per month

Transportation (car payment, car insurance, gas, public transportation, Uber)

Restaurants, fast food, drinks at bars, coffees

Savings/401(k)

Fun (concerts, books, movies, recreational drugs, etc.)

Clothes/beauty (new shoes, laundromat services, makeup)

How much money would you need to live comfortably in Atlanta? What hourly rate or annual salary would you be happy with?

$35 an hour, minimum

What’s a nonessential item that you treat yourself to?

Gaming subscriptions

What would you like to have (that you don’t)?

Vacation and travel

What can be done to improve the cost of living in Atlanta?

Affordable housing

What’s the most challenging thing about living in Atlanta?

Literally, the cost of living

What do you love most about Atlanta?

How diverse the area isRead more

Atlanta roasters reconsider how much a cup of coffee should cost

By January, the signs that Portrait Coffee needed to raise its prices were there. “It was honestly working backwards and looking at all the channels that we sell coffee through and realizing, oh, this isn’t gonna work anymore,” said Portrait co-founder and CEO Aaron Fender.

Coffee prices were already the highest they’d been in 50 years. Supply had continued to dwindle from the disruptive impact of climate change and supply chain issues, but demand was still high: More than two-thirds of Americans drink coffee every day—and consume more coffee than tea, juice, soda, or bottled water. Atlanta, too, is fueled by a robust, independent coffee scene. By one estimate, out of 200-plus coffee shops in metro Atlanta, more than 40 of them are also roasters.

“It was honestly working backwards and looking at all the channels that we sell coffee through and realizing, oh, this isn’t gonna work anymore.” —Portrait co-founder and CEO Aaron Fender

Soon, Fender realized he couldn’t afford not to raise prices on coffee beans, which Portrait Coffee roasts for its own West End cafe, wholesale customers, and Coffee Club subscribers. So he wrote an email—subject line “A Note on Coffee Pricing”—explaining the reasons behind the five to eight percent price increase for specific blends. A standard bag of Portrait’s Toni blend used to cost $16; this year that same bag has cost as much as $17.25. (Looming tariffs are expected to drive costs even higher.)

Fender was delivering the news to customers who were already cost-conscious. Beans are the company’s top seller, in part, because it’s more affordable to brew your coffee at home than to buy it outside. “Some folks can afford to come in and buy an Aunt Viv latte every day,” Fender says, referencing the cafe’s cardamom-flavored specialty. “I can’t. But some people can.”

In recent months, Portrait has started selling two- and five-pound bags to offer even bigger bulk savings. “We’ve seen our direct-to-consumer sales explode. Part of that, I think, is people being really price-sensitive,” Fender says. In the past year, the cost of coffee has risen by 80 percent.

“We’ve seen our direct-to-consumer sales explode. Part of that, I think, is people being really price-sensitive.” —Portrait co-founder and CEO Aaron Fender

Yet the sort of customer who buys an Aunt Viv at the cafe isn’t as likely to notice market forces at work. “What increased a little bit more is the retail bag to make coffee at home,” explained Lucas Cuadros, co-founder of Unblended Coffee, the Colombia-based green, or unroasted, coffee supplier that partners with multiple roasters in metro Atlanta, including Portrait, Brash, and Opo.

Companies buy green coffee beans to roast through futures—contracts to reserve shipments months or even years in advance. Early this year, traders, including hedge funds, snapped up what was left of an already-short coffee supply. After Fender wrote his email, coffee futures prices were $3.60 per pound. The next month, when Portrait’s price adjustments became effective, coffee futures jumped to $4.30 per pound. Today, they’re back at $3.75, which is still nearly double what green coffee cost just a couple of years ago—and it’s the new normal that small roasters like Portrait are trying to navigate.

The way Fender and Cuadros describe the market, one can’t help but compare it to how Wall Street spent billions buying homes nationwide, driving up prices and making houses scarce. “It’s multinational groups that are buying, contracting coffee at volume and scale,” Fender says. “The impact I’m sharing on Portrait is also happening to Folgers and Nestlé. It’s kind of crazy, but we’re all functioning on the same market.”

Still, large companies like Starbucks may not feel as vulnerable, because they likely bought their supply of coffee at yesterday’s price—after all, they can afford to buy futures well in advance. Smaller companies, however, can’t afford to be as impervious.

Across Atlanta, other small roasters are feeling the strain too. “It’s kind of scary, because we are a small business, in comparison to a lot of them in Atlanta,” says Marissa Childers, founder of Tanbrown Coffee. The company, founded in 2022, employs two people, including herself, and bags 100 to 150 pounds of coffee per week.

“It’s kind of scary, because we are a small business, in comparison to a lot of them in Atlanta.” —Tanbrown Coffee founder Marissa Childers

Because Tanbrown specializes in sourcing as many Asian coffees as possible, the price increase to source beans hasn’t been quite as stark. “I’ve seen a lot of South American coffees go from $3 to $6 [per pound]. Whereas Asian coffees, they were already at $5 to $6 per pound,” Childers says. They can be closer to $7 a pound now. Still, the week before Childers spoke with the Cost of Living Project, she notified Tanbrown’s wholesale customers that the company needed to raise its coffee prices for the first time—by 12 percent. Now, thanks to this presidential administration’s tariffs, prices could increase again. “There could be more changes in the future depending on the government’s decisions,” she explained.

“There could be more changes in the future depending on the government’s decisions.” —Tanbrown Coffee founder Marissa Childers

“There has been a little bit of pushback,” Childers said. But she also figures that the more coffee prices climb, the more the people fueled by coffee must reckon with the living wages that their daily cup is supposed to cover. Not just the baristas, of course, but also the farmers who grow the beans, when the cost to import fertilizer has also increased since the Russia-Ukraine war. That’s why, even before recent coffee prices set a new record, Childers believed a cup of drip coffee should cost more than $3.50.

“ Coffee is probably as complex as the winemaking process, and it goes through different hands, but it’s interesting that it’s not respected in the same way,” Childers told the Cost of Living Project. “It’s technically an accessible luxury for people to have every day.”

The supply chain is “lopsided,” she explained: “Not enough money has been supporting the bookends—namely, the baristas or the farmers. It would be surprising to consumers to see how much a cup of coffee should cost if we were looking toward a more equitable supply chain.”

“Not enough money has been supporting the bookends—namely, the baristas or the farmers. It would be surprising to consumers to see how much a cup of coffee should cost if we were looking toward a more equitable supply chain.” —Tanbrown Coffee founder Marissa Childers

She is hopeful, though, that a place like Atlanta, “that really likes local business and has that small city, big town kind of vibe,” can be more empathetic toward all that $3.50 is supposed to cover. “I think once we bring it back to a human level, everyone has more of a connection to it, especially in spaces more connected to farmers markets and local community.”

Meanwhile, the conversations that Fender has had since his email have surprised him. “Literally not a single negative comment—or even anyone being like, I don’t get it—which I was shocked by,” he said.

Going into the 2024 presidential election, voters were frustrated by the price of consumer goods; Fender says he wasn’t excited to add to that frustration. “ I think people are seeing it affect every area of their life, which is unfortunate. But I guess what I’ve seen is people are much more open-minded about where that cause-and-effect stems from, right? It’s not Portrait trying to nickel-and-dime you.” •Read more

Small grocers anchor neighborhoods, but only when we buy in. What will it cost us to reclaim food access and economic autonomy?

After signing papers for their first home, Rossi Rivera and her husband spent an afternoon exploring their new community. A few minutes down the road, they stumbled upon Westview Corner Grocery, a small store owned by a couple who live in the neighborhood. On its yellow-painted brick facade read “THRIFTOWN,” a nod to a local independent chain that once operated in the same historic building, just off Ralph David Abernathy Boulevard.

For Rivera, who had her first child 10 months earlier and was conscious about healthy eating, discovering the store felt serendipitous. It carried all the natural and organic brands she used to buy at big box stores farther into the city. As she settled into the community, Rivera became a regular and made shopping locally part of her lifestyle.

Like others across the country, though, Rivera’s family is feeling the pinch of an unstable economy, as a trade war disrupts supply chains, causing inflation and financial stress for small businesses and shoppers alike. In today’s global economy, how realistic is it for Atlantans to shop local—and why does it matter?

***

Community economist and local investment expert Michael Shuman says the question isn’t whether a purchase is local, but how local it is. He writes about how to build more robust community economies and says the “perfect local purchase” is a product that’s not only sold and manufactured in the community, but also made with local resources. For example, buying a hammer made and sold by a local hardware store and produced by a local manufacturer with local materials keeps more money circulating in the community. If any part of that chain is outsourced—say, the hammer is imported or sold by a national chain—the impact diminishes.

Although polling shows that most people are concerned about the possibility of a recession, Shuman says cost isn’t the only factor they consider when making a purchase—if that were the case, no one would buy a latte for $5. “What people shop for is their sense of value,” Shuman said. That’s why people are willing to pay more for local brands; on some level, they understand that buying local isn’t just a transaction; it’s an investment in their community.

Jenifer Risley, director of operations at the American Independent Business Alliance, organizes campaigns to encourage shoppers to invest in local banks and support small Black- and LGBTQ-owned businesses. Risley said eating locally is the easiest way to start forming a new local-first habit, but any form of local investment will create a ripple effect.

“For us, it’s about ownership. Who actually owns the business? Independent owners who live in the community can make decisions that directly benefit it. Chain stores often lack the flexibility to prioritize local sourcing or hiring,” Risley explained. While shopping at a locally owned franchise has more impact than buying from Amazon, it doesn’t have the same effect as supporting an independent business.

“For us, it’s about ownership. Who actually owns the business? Independent owners who live in the community can make decisions that directly benefit it.” —Jenifer Risley, American Independent Business Alliance

The impact of investing in local businesses goes beyond a single purchase; it’s about the transactions that follow, as those businesses reinvest in the community through payroll, donations, and other contributions. A 10-year study found that, on average, $0.53 of each dollar spent at a locally owned business recirculates in the local economy, compared to less than $0.14 at chain stores.

***

Today, Westview Corner Grocery prioritizes local sourcing and carries Atlanta-based brands like King of Pops and Doux South pickles, but their produce is often shipped from other states or countries. “People ask me all the time, Is your produce local? Some of it is, definitely. But there are no Georgia avocados, and technically Vidalia onions are only in season for a few months,” said general manager Matt Garbett.

Georgia’s state farmers markets generate more than $1 billion annually, and programs like Georgia Grown help connect consumers with farms and producers. But corporate supply chains obscure the farm-to-table process and can make it impossible to trace the origins of products, including Georgia’s top commodity: broiler chicken. Ever stopped to read the USDA labels on packaged chicken? Federal label laws require sellers to disclose if their meat was imported, but not the U.S. state where it was raised. Companies pay fees for organic and non-GMO labels, but to save money, meat corporations or “integrators” may send products out of state for processing. According to William Secor, an agricultural economist and assistant professor at the University of Georgia, cost efficiency drives these decisions. Often, this comes at the expense of transparency.

While not all the brands at Westview Corner Grocery are based in Georgia, the store carries brands from other small businesses that share their values. For instance, they carry an assortment of poultry products from Farmer Focus, which labels each package with a unique Farm ID to learn about the farms where the meat was raised.

As a member of the Independent Food Retailers Alliance, Westview Corner Grocery belongs to a purchasing cooperative representing 350 independent retailers. This allows them to get better pricing from distributors and compete more effectively with large grocery chains.

“Kroger is a multi-billion dollar corporation with X number of stores, whatever, so they get better pricing, because they can bargain with the distributors based on the volume that’s pushing through. So INFRA is doing the same thing, but on behalf of independent stores,” Berry said.

***

After getting off work one Friday in mid-March, Rivera picked up her daughter before swinging by Westview Corner Grocery, her third stop that week. An employee had lit sage at the register, and the Smiths played as Rivera pushed her cart through the aisles. Along for the ride, three-year-old Solace, whose mop of loose curls was pulled into a ponytail, sat quietly in the child seat.

Rivera sees shopping locally as a way to show up for her community and hopes her daughter will learn from her example, even though she can’t exclusively shop at independent stores. Her husband is in the film industry, and they’re still getting back on their feet after the strikes. They frequent Westview Corner Grocery to buy snacks and juices but drive to a chain store further into the city for bigger grocery hauls.

Many Westview residents appreciate the convenience of having a neighborhood grocery store, but few appreciate what it does to their wallets. One regular customer estimated that he spends anywhere from 50 cents to a dollar more per item bought at Westview Corner Grocery. But when it comes to organic and natural products, Westview’s prices for items like milk, fruit, and even certain cuts of meat often match—or beat—those at larger chains. (See the chart below for details.)

Price check on aisle 3

By Julie Thompson

Because Westview Corner Grocery is committed to selling organic and natural options, comparing prices to big box stores can be like comparing apples to oranges. Prices also vary based on which brands a location carries and fluctuate based on sales and promotions, but the following is an analysis at the time of reporting:

Milk: Pricing depends on the brand. A 59-ounce carton of A2 Whole Milk is cheaper at Westview Corner Grocery than the same product at Kroger, Publix, or Whole Foods. Whole Foods, however, offers a generic organic milk brand that costs 10 cents less than Westview Corner Grocery’s cheapest option.

Organic produce: This is where Westview Corner Grocery’s prices effectively compete with corporate chains. A single organic lime costs 20 cents more at Kroger than at Westview Corner Grocery. A pack of organic strawberries for $5.59 beats the $6.99 price at Publix. However, these prices fluctuate seasonally; at the time of this report, the Publix strawberries were marked for a promotion: two packs for $8.

Eggs: Select brands of organic eggs and pasture-raised eggs are cheaper at Westview Corner Grocery. A dozen Vital Farms pasture-raised large eggs costs $6.99 at Westview Corner Grocery, while Kroger charges $7.99 for the same product. To save money, many customers will still opt for nonorganic options at corporate chains, though.

Poultry: Westview Corner Grocery’s organic chicken thighs are the same price as those at Publix but nearly twice the cost of Kroger’s. Farmer Focus breasts, however, are 50 cents cheaper at Westview Corner Grocery than at Publix.

Bread: Most of the bread at Westview Corner Grocery comes from Alon’s Bakery and costs more than chain-store brands. A four-pack of brioche buns sells for $3.99, compared to $4.79 for a six-pack at Publix and $6.99 at Whole Foods.

Canned goods: Cans are typically cheaper at chain stores. A can of Amy’s Organic Chunky Tomato Bisque at Westview Corner Grocery is 60 cents cheaper at Publix, 80 cents less at Whole Foods, and $1.20 less at Kroger. •

Still, Westview residents are fortunate to live within walking distance of fresh food; that’s not the reality most Atlantans face. In 2024, the USDA identified more than 35 food deserts in metro Atlanta, where the nearest grocery store is more than five miles away. Even as nonprofits and city leaders collaborate to tackle food insecurity, the Trump administration’s proposed budget cuts to food assistance programs and deregulation of nutrition programs could undermine those efforts. And, as tariffs go into effect, the nation could be on the brink of a recession.

“Today we got so many bad things happening, so many negative things, but I have started seeing more of the community pulling together,” said Yolanda Travis, a regular at Westview Corner Grocery. “It’s happening slowly, but building community with our local groceries—that’s the antidote.” •

5 places to shop local

By Nile Kendall

An Atlanta staple since 1924, the Municipal Market, also known as the Sweet Auburn Curb Market, is on Edgewood Avenue in the heart of Atlanta. There are 28 independently owned businesses here where locals can grab a bite to eat or shop for fresh meat, seafood, and produce.

Located in Little Five Points, Sevananda is Atlanta’s only co-op grocery store. It sells local organic food, seasonal produce, bulk herbs and spices, and other health and wellness products.

Lucy’s Market in Buckhead was founded in 2009 by Kim Wilson. Inspired to start a market by her own backyard vegetable garden, Wilson offers a curated selection of the freshest local produce from Georgia.

Tucker Farmers Market sets up shop on Thursdays from 4 p.m. to 7 p.m., spring through fall, at St. Andrews Presbyterian Church. The market carries products from more than 30 vendors, including local farmers, butchers, bakers, florists, and food trucks.

Your Dekalb Farmers Market, established in 1977, is still owned and operated by its founding family. It’s known for a wide variety of spices, produce, and vegetables, and is open seven days a week in Decatur. •Read more

Meet a 26-year-old graphic designer from EAV

This 26-year-old graphic designer and animator lives in East Atlanta Village on around $65,000 a year. She says she loves her apartment and living in EAV: It’s lively, there are good places to hang out, it’s walkable, and it’s close to downtown and Midtown. “Nowhere I need to be is more than a 30-minute drive,” she says.

Still, she thinks rent prices have become “really absurd.” “These landlords and rental companies don’t care,” she added. “They don’t care that your stuff is broken, that your car is broken into, that things are low quality. They are making a crazy amount of money on you filling an apartment.”

When it comes to her personal budget, her splurges usually revolve around food. She doesn’t shop with a grocery list, which she thinks is one way to start saving money: “Know what you want to cook with and don’t be like me and want to buy everything that tastes good or that you want to cook with later, but then you might not and it’ll go bad.”

For fun, she does costuming and conventions. “That is a totally unnecessary money sink for the sake of the hobby and seeing friends,” she says. Still, she manages to put at least $500 a month toward savings.

While she’s currently spending around $1,000 a year on travel, she wants to see more of the world and travel abroad. In the meantime, despite disliking having to drive everywhere, she likes exploring the metro: “I enjoy being able to take myself to new places or quickly leave the city to see forests or rivers or parks and not feel trapped in a city.”

Soon, she’ll be kicked off her parent’s health insurance plan. “I’ve been dreading this moment, but I knew it was coming,” she says. “I’m getting a lot of healthcare out of the way this year.”

Graphic designer, animator

Neighborhood

East Atlanta Village

Annual gross income

Student loans and credit card debt

$30,000 in student loan debt

Health insurance cost per month + cost of any prescriptions

$30 on prescriptions, but I’ll be kicked off my current health insurance plan at the end of the year.

Phone plan and monthly subscriptions (Netflix, Spotify, food delivery services, apps, etc.)

Utilities per month

Transportation (car payment, car insurance, gas, public transportation, Uber)

$295 car payment + $40 on gas a month

$100 to $200

Restaurants, fast food, drinks at bars, coffees

Savings/401(k)

I try to save at least $500 a month if possible. I have $5,000 in savings at the moment.

$1,000 total for weekend trips, vacay, etc.

Fun (concerts, books, movies, recreational drugs, etc.)

$25 to $75

Clothes/beauty (new shoes, laundromat services, makeup)

$50 to $150, depending on the month (hair services, nails every other month)

How much money would you need to live comfortably in Atlanta? What hourly rate or annual salary would you be happy with?

$80,000 to $100,000 would be a delight.

What’s a nonessential item that you treat yourself to?

I seem to splurge most on food. I enjoy cooking a lot, and, where I could be way more money-conscious on groceries or takeout, I tend to get a little excited and overzealous and spend more to enjoy new cuisines or cook new, interesting things. I also do costuming and conventions, so that is a totally unnecessary money sink for the sake of the hobby and seeing friends.

What would you like to have (that you don’t)?

I’m extremely fortunate to have most everything I need and then some. I’d like to travel abroad more and gain new experiences. I feel like this could be in reach, but due to work, other bills, and things I like to spend frivolously on at the moment, it seems out of reach.

What can be done to improve the cost of living in Atlanta?

I think a lot of apartments and rentals are getting big for their britches.

What’s the most challenging thing about living in Atlanta?

DRIVING EVERYWHERE. And rent.

What do you love most about Atlanta?

I love how everywhere you go, in and out of the Perimeter, it feels wholly different. There are so many people to meet, foods to try, history to learn, and things to do and see. While I dislike driving, I enjoy being able to take myself to new places or quickly leave the city to see forests or rivers or parks and not feel trapped in a city. •Read more

Georgia legislators introduced bills to limit corporate ownership in Atlanta’s housing market. Most of them stalled.

Before Gabriel Sanchez was a Georgia state representative, he was just a downtown Atlanta resident trying to survive the pandemic in an apartment that kept flooding.

The complex had on-site staff, but Sanchez’s landlord did not live in Georgia. “It’s one of those things where you have these owners who are far removed from the actual property they own, so they have little to no care about what happens outside of what the law requires,” he says. Sanchez, a Democrat who now represents Smyrna in the state House, believes if he had a direct connection with the building’s owner, his experience could have been different. “This is what happens when you commodify housing and make it a profit motive instead of something that people need,” he says.

The commodification of housing doesn’t just apply to apartment buildings and condos: According to a Georgia State University study, three real estate investment companies own more than 10 percent of the single-family homes available for rent in metro Atlanta. “We run the highest percentage of corporate ownership in the housing market—[higher] than any other market in the country,” Sanchez explains.

“We run the highest percentage of corporate ownership in the housing market—[higher] than any other market in the country.” —Gabriel Sanchez, Georgia state representative

Beginning with the 2007 foreclosure crisis—and picking up again with the COVID-19 pandemic—many local landlords and homeowners sold their properties, enabling real estate investment companies to buy homes en masse and rent them out strictly for profit, as so-called corporate landlords. These companies can purchase properties for more than they’re worth, presenting sellers with cash offers that individual homebuyers can’t compete with, and they’re pricing homebuyers out of the market. In fact, investment funds account for more than a third of the recent home purchases in metro Atlanta. Just three companies own more than 19,000 metro Atlanta homes. “You can throw that dream out the window,” said Kelsea Bond, housing advocate and Atlanta City Council District 2 candidate, at a recent Housing Justice League rally for rent control. “We’re not buying a house.”

“You can throw that dream out the window. We’re not buying a house.” —Kelsea Bond, housing advocate and Atlanta City Council District 2 candidate

During this year’s legislative session, four bills were introduced in the state House to address the rise in corporate landlords: House Bills 305, 399, 555, and 864. Out of those bills, only one passed. These are just a few of many housing bills that were proposed this session to address the commodification of housing. We chose to focus on bills that dealt with corporate landlords in particular.

House Bill 305, or the Protect the Dream Act, was sponsored by five Democrats and one Republican. This bill aimed to make it illegal for corporations to own more than 25 single-family homes per county. It stalled in the Governmental Affairs Committee.

House Bill 555, or the Georgians First Residential Property Protection Act, was sponsored by five Republicans and one Democrat and aimed to “prohibit business enterprises from owning an interest in more than 2,000 single-family residential properties or ten multifamily residential properties.” This bill was sent back to the Judiciary Committee for review.

Even though both bills stalled, Matthew Nursey, an organizer and policy advocate with the Housing Justice League, is encouraged that both House Republicans and Democrats introduced policy this year condemning the rise of corporate landlords.

“There’s an appetite on both sides of the aisle to address the large-investor issue. For more conservative people, it’s about resources leaving the state,” Nursey says. “These corporate landlords are from New York, California, Israel, all over the place. They’re not from Georgia. Millions upon millions of dollars are leaving the state that can be kept here.”

With fewer people able to purchase a home, more are renting, which, in turn, is driving up rent. In February 2020, just before the onset of the pandemic, the average rent in Atlanta was $1,506, according to Zillow. By February 2025, it had increased nearly 25 percent, to $1,870.

In December, former President Joe Biden’s Council of Economic Advisors released a report attributing some of this increase to RealPage, a property management software company that sells rental price-setting software to landlords. RealPage’s software uses artificial intelligence to adjust rental rates, using nonpublic rental rate information that landlords share with the company to recommend rental prices to competing landlords.

The CEA report estimated that nearly half of Atlanta’s available rental units are affected by RealPage’s algorithms and claimed that the company has added about $181 per month to Atlanta renters’ costs—way more than the national average increase of $70.

Last August, the Department of Justice announced it was suing RealPage for antitrust violations and price fixing. The DOJ dropped its criminal investigation into the pricing practices of multifamily housing in December. In January, the department escalated its civil suit against algorithmic pricing, amending the suit to include six corporate landlords, one of which is Atlanta-based Cortland Management. Many cities have fought back against RealPage. San Francisco and Philadelphia recently passed laws restricting algorithmic rent-pricing software; other city and state legislators are following suit.

In February, Sanchez and five other Democrats sponsored House Bill 679, or the End Rental Price-Fixing Act. The bill aims to ban landlords in Georgia from using AI to set rental prices and prevent providers of this software from selling it to multiple landlords in the same market for collusion. The bill did not make it out of the House, but it did get a hearing in the Judiciary Committee. Sanchez says he will push for a vote next year.

Late this session, Sanchez introduced another bill (again sponsored by five other Democrats): House Bill 864, or the End Corporate Ownership of Georgia Homes Act. The bill would require corporations to report the number of single-family homes they own and sell 20 percent of their homes each year by imposing a $750,000 fine for each home they own in excess.

“There are definitely other factors as well, but if we don’t fix this [corporate ownership] issue, the housing crisis will not be solved,” Sanchez says. “We have to stop these huge corporations from buying our homes. They’re jacking up the prices and making it unaffordable for the rest of us.”

“There are definitely other factors as well, but if we don’t fix this [corporate ownership] issue, the housing crisis will not be solved.” —Gabriel Sanchez, Georgia state representative

On the last day of this year’s legislative session, House Bill 399, sponsored by four Democrats and three Republicans, passed the Senate. This bill will require out-of-state landlords who own 25 homes or more in Georgia to employ at least one person in-state who is responsible for responding to and managing their tenants’ property issues. “[House Bill 399] does apply mainly to single-family homes, but I still think it’s a decent start,” Sanchez says. “It’s a decent bill that could help with some of the issues people face.” It’s heading to Governor Kemp’s desk for a signature now.

Nursey wants lawmakers to realize that governmental mandates are necessary to prevent large enterprises from keeping their stronghold on the Atlanta housing market. “For capitalism to work, you have to have guardrails and safety nets,” Nursey says. “Clearly, [corporations] are creating monopolies, and that shouldn’t be allowed. It’s against the law. So we need to create protections to minimize the amount of properties that corporate landlords can buy.” •Read more

As Trump’s tariffs go into effect, entrepreneurs figure out ways to navigate “America First” policiesRead more

One of the things that most worries this analyst who works in the government is healthcare costsRead more

She affords herself some luxuries, like Botox, but doesn’t spend on regular manicures or name-brand groceriesRead more

The Tri-Cities were once hidden gems for Atlantans in search of close-knit communities and reasonably priced housingRead more

The Tri-Cities were once hidden gems for Atlantans in search of close-knit communities and reasonably priced housingRead more

It’s been more than 40 years since Atlanta updated its zoning code, since before the Beltline and even before the Olympics.Read more

In Atlanta, housing is limited, expensive, and often far from campus. That can mean long commutes, tight budgets, and tough choices.Read more

Here’s what they shared Our friends at Tallymade polled ATL Living Lab guests during events on Donald Lee Hollowell, Buford Highway,…Read more

For decades, Gwinnett County has struggled to expand public transportation. Could microtransit help?

Next month, Gwinnett will ask voters to approve a countywide rideshare system.Read more

Lisa dreams of an electric tricycle with a sidecar for her petsRead more

This week, a bus tour advocating for caregivers made its final stop in Atlanta—the birthplace of the domestic workers’ movementRead more

Mutual aid isn’t charity—it’s about creating a culture of collectivity. Here’s how organizations are putting that philosophy into action.Read more

In the wake of a water crisis, Atlantans take a closer look at the city’s prioritiesRead more

Meet an environmental specialist in Cabbagetown who dreams of international travel and a $15,000 raiseRead more

Nearly 30 percent of downtown is covered in parking spots. Here’s why that’s a problem—and what Atlanta can do about it.Read more

Jenn dreams of leisure time in the North Georgia mountains, biweekly manicures, and a dental planRead more

By 10 a.m., there is already a line out the door, through the courtyard, and up the stairs outside Central Presbyterian Church.Read more

At a recent housing affordability workshop, participants put themselves in the shoes of an Atlanta renter. Things got complicated.Read more

Here’s how the City of Atlanta is trying to build (or preserve) 20,000 affordable housing units by 2030Read more

After navigating unsafe living conditions for more than a decade, my family escaped the perils of renting in Georgia. What about the tens…Read more

With the rise of pop-up shops, small businesses are increasingly going beyond the brick-and-mortar. The new model offers a low barrier to…Read more

Our new event series is part block party, part charrette with interactive exhibits and expert panels designed to demystify the…Read more

How the government determines “fair rent,” where it fails, and why you sufferRead more

A program providing driving classes to refugee and immigrant women is on hold due to lack of fundsRead more

Readers and Canopy Atlanta staff members weigh inRead more

The Cooper Center works to reduce risks associated with homelessness, mental health crises, pregnancy, and substance use.Read more

U.S. Senator Jon Ossoff listened as tenants described unsanitary and dangerous conditions in the places where they livedRead more

For the 10th year, Georgia is the country’s “top state for business.” Here’s the story behind the superlative.Read more

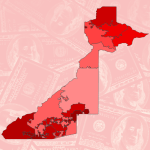

Fulton County’s property tax system exacerbates inequality between the north and south—and between Atlanta’s richest and poorest homeowners.Read more

The Little Bodega is a free grocery pop-up that models a new way of feeding families in needRead more

During the holidays, André is the Black Santa of Atlanta. For the rest of the year, he’s a firearms safety instructor, a husband, and a dad.Read more

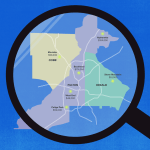

The Cost of Living Project has spoken to hundreds of people (from 54 zip codes and counting). Here’s what we’ve learned so far.Read more

Holiday work no longer means ringing up purchases at the department store. Still, there’s room for the occasional Santa. It’s a busy…Read more

People are donating a smaller share of their income than at any point in decades. But Atlantans are still finding other ways to help.Read more

Driving lessons are hard to come by. These nonprofits are working to give immigrants and refugees mobility in car-dependent metro Atlanta.Read more

Here are a selection of the best opportunities to give a little money from around the Atlanta area.Read more

A GSU student working toward his doctorate, Benjamin Krysiek knows how hard it is for people with disabilities to find affordable housing.Read more

The program waitlist is open for the first time since 2021—but only for a few days. Here are the FAQs about HCVs.Read more

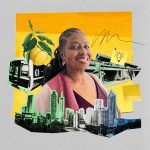

Vanessa Alexander stays rooted in her community with a prayer line, Bible studies, and neighborhood cookoutsRead more

Susan McCracken on the importance of community—and her dream of moving to the mountainsRead more

Woolridge’s new home is “a land of opportunity,” a center of “Black excellence,” and a healthcare desertRead more

Members of our inaugural fellowship cohort will support the reporting needs of the project—and pursue stories of their ownRead more

We’re giving 8 teens $100 (+ a disposable camera) each to photograph their neighborhoodRead more

This 56-year-old former real estate analyst likes to joke that she’s another local living the life of “home-loaner-ship”Read more

A lifelong Grove Park resident on what it’s like to be caught in a gentrification feedback loopRead more

How many rent payments can I miss before my landlord can evict me? If I’ve been evicted in the past, can landlords automatically reject me?Read more

In Atlanta, the TAD program has been credited for billions of dollars in assessed property value growth since the program began in 2001Read more

This 54-year-old’s family’s combined household income—he lives in East Cobb with his wife and son—is $150,000Read more

Georgia has some of the weakest tenant protections in the country. But, tenants still do have rights. Here is some advice from experts.Read more